Get Started With

servzone

Overview

The sale deed provides proof of the sale and transfer of property ownership, a legal contract executed by the seller; Buyer. The sale deed is an essential document for both the parties which are registered as per the Registration Act, 1908. It is signed after both parties agree on the terms mentioned in the agreement. & Event.

When purchasing real estate, you have to ensure the relevant details, such as fixed price, any arrears associated with it, total area of ​​the property, transfer of ownership, etc. You need to know the process of this, the sales deed, the necessary elements and even the sales deed format for proper execution of this process.

What are the terms in the sales deed?

-

Vendor / transferor

A seller is one who is eager or willing to sell his property at a price that he has current ownership to sell.

-

Witness

The person who signs the sale deed accepts the fact that the buyer and seller have signed the signed deed, are known as witnesses.

-

Transfer / Buyer / Buyer

Transferre or purchaser or purchaser is a person who is willing or willing to buy property from seller.

-

Stamp duty

Government imposed fee on legal acknowledgment of certain documents. It is a type of property tax, while a property is being sold, which has to be paid to the concerned administration. It is calculated at the market price (whichever is higher), where stamp duty charges vary from state to state.

-

Title

Title refers to the proper way of owning property (saying that you have the right to something), assuming that you have the right to practice it. However, you can never move more legally than yourself and be subject to property or partially full interest.

Since you have a title, you can access the land and possibly modify it as you understood. The title also implies that you can transfer the concern or slice / share that you hold to another person.

-

Registration fee

Registration fee is required to be paid for the acquisition of property transferred and registered (in addition to stamp duty fee) in your name. The fee is subject to a maximum amount of Rs. 30,000 (either 1% of the market value or the settlement price), which is varied in different states.

-

Sale Price

The price of the property is agreed to by both the seller and the buyer.

-

Execution

The sale deed is executed when all parties such as the seller, buyer, and witness sign after preparing the sale deed or make a thumb impression accepting the same document.

-

Registration

To be legalized the sale deed must be registered under the Registration Act 1908. In addition, all this can be done in the presence of both parties in the office of the Registrar.

-

Proof of registration

Certified / verified copy of registered lease deed with the name of the buyer can be obtained from the Registrar Office. In the future, it may serve as a 'proof of registration'.

-

Sales Agreement

It is an agreement that specifies the property for the buyer and seller and the agreed price between the seller and the buyer and seller.

-

Mode of payment

This refers to payments for transactions made through checks, cash, online transfers and many more.

Important elements

-

Property Explanation

The sale deed format should contain a complete description of the sale deed, such as the name & address of the buyer and the seller i.e., executing parties.

-

Sales Ideas

If any advance payment is made, the selling price must be agreed between the buyer and seller and stated in the sale deed format. The sale deed should include all information related to the mode of payment, which can be added via demand draft, check or online transfer, which is also required on a case by case basis.

-

Explanation on duration

When passing the title to the buyer, time must be mentioned in the sales deed format. This should be complete with all documents that must be handed over to the buyer by the seller.

-

A mandatory clause on title transfer

The seller should make sure there aren’t Fees and any arrears or burden before handing over the property. The buyer will cover the expenses incurred to the seller, if there is any outstanding balance.

-

Stamp duty: registration of sale

Any unregistered sale deed has no value in the eyes of law; Therefore, the sale deed must be registered with the local sub-registrar office. The importance and value of these papers is the money you want to pay as stamp duty, and the details must be typed on non-judicial stamp paper.

The sale deed must be registered with the judicial sub-registrar office, which may be mandatory to draft on non-judicial stamp paper.

As per the stamp act of the respective state, non-judicial stamp paper is purchased according to the circle rates of the state in the country. An example of a safe understanding; Stamp duty is 6% for a male and 4% for a female in Delhi. So, stamp duty if you have, Rs. 60,000’re a man and buying a property worth Rupees 10 lakh.Moreover, for your knowledge, different preferences of e-stamp are obtainable in the states- Karnataka, Delhi, Uttarakhand, Gujarat, Rajasthan, Punjab, Odisha, Tamil Nadu, Jharkhand, Daman & Diu, Himachal Pradesh, Dadra & Nagar Haveli, Assam, Uttar Pradesh, Chhattisgarh, Puducherry, Andhra Pradesh, Jammu & Kashmir, and Chandigarh. One has to fill the form physically in the case of other states.

Required documents

You should mention the following in the papers after you have purchased the papers.

They are as follows: -- Names of the parties involved (buyer and seller)

- PAN card and pictures of buyers and sellers.

- Name of the person purchasing the stamp

- Total stamp duty fee

- Names and addresses of 2 witnesses

- Title deed / draft of sale deed / conveyance deed

- Account Certificates and Extracts

- Receipt of registration fee payment of deal value and all financial statements (including TDS payment).

- Power of Attorney, if any

- 7/12 extracts or records of the Rights and Tenancy Corps (RTC) or

- A copy of all registered final agreements (in case of re-sale property)

- Building plan authorized by statutory authority

- If any loan (previous / current) on the property / original property document with the bank

- Joint Development Agreement, GPA, & Shared / supplementary agreement between the landlord and the builder

- All title documents of the landowner

- Allocation letter from Builder / Co-operative Society / Housing Board / BDA.

- NOC from the Apartment Association (in case of resale property)

- Sales agreement with seller

Registration process

- Visit the office or book an appointment online with the sub-registrar. You can also go to the Sub-Registrar Office reception for the same.

- In Delhi, check to book the same. You would get a swipe card and a token by showing this appointment ID.

- Visit the Facilitation Center, where documents are vetted before being sent to the sub-registrar (only the parties involved are allowed entry).

- At that point, the authorities will request the buyer and seller to sign their fingerprints and all pages of attached documents.

- After close inspection, the Sub-Registrar will re-examine the documents. He can reject them in case of any discrepancies.

- Both parties proceed to the biometric division upon acceptance. Biometrics will be taken for fingerprints and photographs.

- A receipt will be issued to you after the completion of this process. Within 15 days of the registration process, the buyer can submit the sale deed.

Note: Both parties are scheduled to come to the sub-registrar office with two witnesses. Conversely, do not forget to keep your original ID proof and property registration payment receipt and TDS. An appointment ID is created after online confirmation, which you will have to carry with you as proof.

What to keep in mind while registering?

- Property should not be subject to any due liability / burden.

Financial inconveniences should be checked whether the buyer is making purchases related to such encumbrances, or whether the burden or encumbrance on the property included in the agreement is accurate. The seller must pay the loan so that the property's credentials are cleared of any burden on it, if not more so. The purchaser or buyer must verify from the Registrar's Office whether any such existence on the property is notable.

- Before the property is disbursed by the owner or seller, it should be noted that all payments must be completed on time.

The seller must make all payments before execution of the sale deed. They may include terms such as water bills, electricity bills, cess and property tax, and other maintenance such as social maintenance fees etc.

- Mortgage on the property and mortgage for the duration of the sale deed In the case of mortgaged property in relation to returning the excess payment of the loan, the pledge will supersede the sale deed agreement.

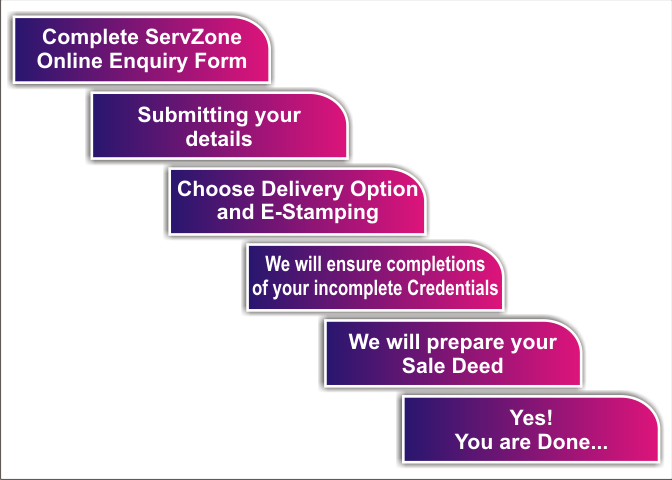

Procedure

Servzone advises you to get in touch with a lawyer to understand the requirement in detail. Initial information will be mandatory from your end to start the process. After providing all the information, the lawyers will start working on your document and payment will be received. Also, you will get the first draft of your authorized document within a few days. You can evaluate the document, and you can intimate it for improvement in case of any amendment.

Why Servzone?

Servzone will ensure you to provide legal support for legal functions in all your compliance functions, with the expertise of our team of legal professionals & amp; Business advisor using our technical capabilities. Come on board and experience comfort and convenience!

Servzone ensures genuine expectations, a seamless interactive process with the government through all paperwork. Yes! You are only one phone call away from the best in legal services

GST Registration

PVT. LTD. Company

Loan

Insurance